Commercial Outdoor Solar Lighting Applications

Solar Powered Street LightingUse our solar powered street & roadway LED light solutions to illuminate your drive. |

Solar Parking Lot LightingHelp protect your business and pedestrians by using our outdoor solar lighting for parking lots. |

Solar Pathway LightingUse our solar LED lighting solutions to illuminate your pathways & walkways. |

Solar Park LightingTry our aesthetically-pleasing outdoor solar lights for your parks & public open spaces at an unbeatable price. |

Solar Security LightingProtect your business and property around the clock with our industry-leading solar powered lighting for security & perimeters. Provides area lighting and attachable to a motion sensor. |

Solar Sign LightingLearn more about how our solar LED lighting fixtures & panels can light up your signage all night long. |

Why Greenshine for Your Solar LED Lights?

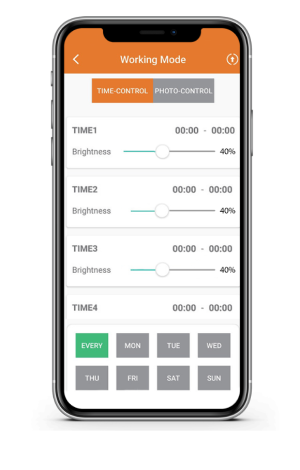

CUSTOMIZED LIGHTING

We customize every piece of our solar powered lighting systems to ensure they meet the optimal requirements for the environment, temperature, and sunlight duration in your local area.

|

EXCELLENT CUSTOMER SERVICE

Our US-based team is dedicated to your satisfaction and will provide attentive service every step of the way. We make the process of installing solar LED lights painless and smooth.

|

INDUSTRY EXPERTISE

Greenshine’s expert team has more than 30 years combined experience developing outdoor solar lighting solutions. Our engineers will take care of all the technical work as well as help you choose the best design for your project.

|

FINANCING AVAILABLE

Greenshine partnered with Balboa Capital, a top-rated direct lender to offer fast, easy, and affordable equipment financing options, helping you preserve your capital and credit line.

|

Why Go Off-Grid with Solar Powered Lighting

NO TRENCHING REQUIREDTraditional lighting requires you to dig up large portions of earth in order to connect to the power grid. With outdoor solar lights, there’s no need to get your hands dirty or make a mess of your property. |

NO OUTAGESWhen the power goes out, traditional outdoor lights fail. Not solar powered lights! Our autonomous systems keep your lights shining no matter the condition. |

INSTALL ANYWHEREToo far away from grid power? Solar LED lights are the solution. No area is too remote to receive power when it’s delivered by the sun. |

SAVE MONEYOutdoor solar lighting not only helps you save on your electric bill and trenching costs but also allows you to take advantage of government rebates and tax incentives. Additionally, our solar LED lights are low maintenance, saving you time and money for years to come. |

IMPROVE SAFETYExterior lighting is important for the protection of people and property. Whether it’s reducing crime or ensuring public safety, our easy-to-install outdoor solar lights have got you covered. |

GO GREENInvest in technology that invests in the future; solar lighting is extremely clean, has a minimal carbon footprint, and uses zero fossil fuels. |

Testimonials

-

“It’s been a pleasure doing business with Greenshine – the representative has been super accommodating and very patient with us.”

- Keith D.

Land Development Manager -

“We’re very pleased by the outcome of this project and the quality of Greenshine's product. We have name Greenshine New Energy "Preferred Solar Light Vendor” for the City of Mammoth Lakes.”

- Ron F.

Lighting Lead for City of Mammoth Lake -

“We could not have asked for better representatives at Greenshine! They have been extraordinarily helpful and patient through the process. Their knowledge and suggestions have us feeling confident that we are making the correct choices for our upcoming purchase. We look forward to a longstanding relationship with Greenshine!”

- Greg I.

Teacher and Project Lead for Parking Lot Lighting -

“We chose Greenshine for the first solar powered streetlight project in the City of Charleston. That’s quite an accomplishment for a community in the heart of coal-fired electricity generation. I really appreciate the help from the company!”

- Rod W.

Lighting Lead for City of Charleston

Want to get the best information about industry standards in solar lighting?